EB-5 Investment Opportunities 2025: Top Sectors for Job Creation and ROI

EB-5 Investment Opportunities 2025: Top Sectors for Job Creation and ROI

Blog Article

To pursue the EB-5 visa, you'll need to invest a minimum of $800,000 in a designated development zone or $1,050,000 in non-TEA areas, while ensuring your funds generates or preserves at least 10 full-time U.S. jobs. This pathway presents you and your loved ones a route to permanent residency, but managing the complex requirements, job creation rules, and documentation requirements can be difficult. Experienced EB-5 attorneys can enhance your strategy, protect your investment, and handle legal hurdles—here's how to ensure favorable outcomes throughout the process.

Essential Insights

The EB-5 Visa Program: A Historical Overview and Purpose

Since the U.S. government has consistently looked for ways to boost domestic economic growth, Congress implemented the EB-5 Immigrant Investor Program in 1990 as an initiative to strengthen the American economy through overseas funding and workforce expansion. The program's history reveals its progression from an entrepreneur's copyright an investor's visa, designed to attract international investment into commercial projects.

In 1992, Congress enhanced the program's investment framework by introducing the Immigrant Investor Pilot Program (also known as) the Regional Center Program, which permitted investors to include both direct and indirect jobs toward the mandatory 10-job creation threshold. This enhancement made the program more compelling by allowing passive investments through pre-approved regional centers, significantly boosting participation rates after 2005 when USCIS established reforms to simplify the application process.

Comparing TEA and Standard Investment Requirements

The EB-5 Immigrant Investor Program has evolved from its original design to feature multiple investment levels designed for distinct economic regions. For investors, it's important to know about the two capital deployment options at your disposal.

The standard investment requirement is currently $1,050,000 for projects located outside designated areas. Nevertheless, when investing in a designated TEA zone—which includes rural areas or locations with high unemployment—you'll benefit from a lower investment amount of $800,000.

Regardless of which investment threshold is relevant for your situation, you need to ensure your capital generates at least 10 full-time employment opportunities for qualifying U.S. workers. These distinct investment requirements demonstrate the program's aim to stimulate economic growth in areas that require the most support while providing investors a route to permanent residency.

Job Development Standards: Achieving the 10-Job Requirement

For EB-5 investors, you're required to create or preserve no fewer than 10 full-time jobs for eligible U.S. workers during two years of receiving a Conditional copyright. Although direct investments mandate you to form employer-employee relationships with your enterprise as the direct employer, regional center investments offer greater flexibility by allowing up to 90% of your job creation requirement to be met through indirect jobs created as a result of your investment. When looking into funding a troubled business, you can meet requirements through job maintenance rather than new job creation, as long as you maintain existing employment at pre-investment levels for at least two years.

Direct and Indirect Employment Opportunities

Satisfying the job creation requirement forms the core of a successful EB-5 copyright, with distinct options available depending on your investment structure. When you select a direct investment, you must prove direct job creation—your business must employ at least 10 full-time U.S. workers directly, creating an employer-employee relationship within your new commercial enterprise. Alternatively, if you invest through a regional center, the rules permit you to count both direct and indirect job creation. Indirect jobs are those generated as a result of the project’s economic activity, such as jobs at suppliers or service providers, broadening your options for fulfilling the 10-job threshold with increased flexibility.

Benefits of Regional Centers

Opting for a regional center provides a streamlined path to satisfy the EB-5 program's 10-job qualification, offering flexibility that's particularly valuable for investors who prefer a less hands-on approach. This investment option permits you to count various forms of job creation, greatly increasing your potential to comply with USCIS standards.

One of the main benefits of the regional center option is the limited management responsibility. You don't have to be involved in day-to-day business operations, making it possible for you to continue unrelated job while working towards your copyright.

Numerous regional center projects are positioned in targeted employment areas (TEAs), allowing you to qualify for the lower $800,000 investment threshold rather than the standard $1.1 million requirement. Moreover, exemplar approvals provide added confidence—when you invest in a pre-approved project, much of your I-526 petition is previously verified, requiring only your source of funds documentation for review.

Job Maintenance Options

Although numerous investors focus on establishing ten jobs, maintaining those positions throughout the required investment period is equally important for EB-5 compliance. For investments in a troubled business, you must demonstrate that existing jobs haven't been lost—this is where job retention strategies become essential. Following employee standing, retaining qualified U.S. workers, and guaranteeing full-time employment are all essential actions. Employment verification should be systematically tracked and verified to prove that jobs were maintained during the investment window. Strategic implementation of a job buffer—generating more than the minimum ten jobs—can provide a safeguard against unexpected setbacks, minimizing risk and bolstering your position for meeting EB-5 requirements.

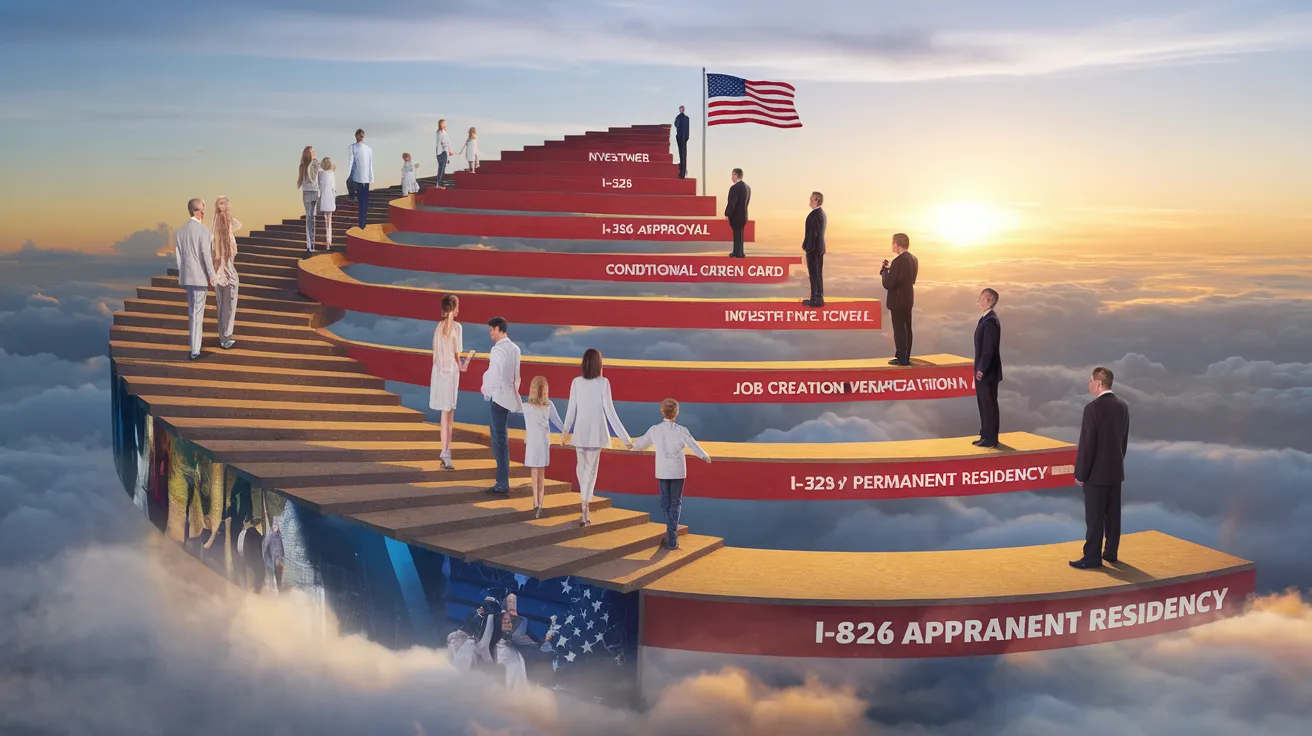

Navigating the Process: I-526 Petition to Conditional copyright

Your EB-5 journey begins with completing Form I-526, which typically needs between 71.1 months to process, although rural projects could get expedited approvals in as little as 11 months. You will then move forward through either status adjustment (if you're in the U.S.) taking 6-8 months, or consular interview process (if outside the U.S.) involving DS-260 filing with an interview typically scheduled within 60-90 days after USCIS approval. In the final step, you will need to file Form I-829 to lift the conditions on your copyright status, a process that typically takes 22-48.5 months but finally permits you and your family to live permanently in the United States.

I-526 Petition Filing Process

The journey commences when you submit and file Form I-526, the Investment-Based Immigration Petition, with U.S. Citizenship and Immigration Services (USCIS). Your petition must verify eligibility and prove your considerable investment in a legitimate U.S. business.

As you prepare your I-526 checklist, compile evidence demonstrating your investment funds origin, business planning documentation, and employment generation forecast. Decide between regional center or direct investment options according to your financial aims.

Present petition processing timelines differ considerably, with USCIS primarily processing forms lodged prior to March 15, 2022. Once approved, you will need to continue with filing Form DS-260 to initiate your immigrant visa registration.

The petition acts as your official application demonstrating conformity with EB-5 requirements and investment commitment. While processing can be lengthy, comprehensive documentation confirms your submission fulfills all conditions for moving forward toward permanent residency.

Adjustment of Status vs. Consular Processing

After receiving I-526 petition approval, you will need to choose between two distinct paths to acquire your EB-5 conditional copyright: consular processing or adjustment of status. Your immigration status and present location upon receiving approval will dictate which path is best for you.

Consular processing is required when you're not in the U.S., which involves completing the DS-260 application and civil documents with the NVC, leading to a mandatory interview at an American consulate.

You can only adjust your status if you maintain legal status in the U.S. While this pathway typically offers a quicker processing time and enables you to travel and work during processing with authorization to work and travel documents, not everyone is eligible for this pathway.

Each pathway eventually results in permanent residency but differs considerably in process requirements and timeline considerations.

Lifting copyright Restrictions

Following petition approval and you 've navigated either consular processing or adjustment of status, you 'll be issued a conditional copyright that's good for two years. To lift the conditions on your permanent residency, you must file Form I-829 in the 90-day period before your card expires. You must to demonstrate you've met all residency requirements: sustained your investment and verified your business has generated or will generate at least 10 full-time jobs. Fulfilling these conditions is critical. Not filing your I-829 petition on time could cause the cancellation of your copyright status. Prompt, proper filing, accompanied by thorough documentation, is crucial for eliminating conditions and securing long-term residency benefits.

Converting Your Conditional Status to copyright

When your two-year conditional copyright status is nearing its expiration, resulting from your EB-5 investment, you'll need to undertake the critical process of removing these conditions to obtain your copyright card.

As a conditional status investor, your primary duty is completing Form I-829 (Application for Removal of Entrepreneurial Conditions) in the 90-day timeframe leading up to the second anniversary of being granted your conditional copyright. This petition must show that you've maintained your investment during the required period and that your commercial enterprise has generated, or will establish within a reasonable time, at least 10 full-time positions for qualified staff.

Your legal counsel will gather paperwork that supports these requirements. Frequent obstacles include keeping accurate investment records and handling accounting issues that may reveal your capital balance falling short of the necessary minimum.

Common Challenges and Pitfalls in the EB-5 Process

The EB-5 immigration pathway presents multiple important obstacles that investors should handle strategically to reach their goals. Processing slowdowns frequently occur, stemming from visa backlogs and extended review periods, which can impact your immigration timeline. Investment risks are ever-present; not performing thorough due diligence on projects risks your capital and visa eligibility. Paperwork challenges, specifically concerning source of funds, frequently result in requests for evidence or denials if not meticulously prepared. Regional center selection requires careful consideration—making an incorrect choice creates compliance challenges and financial transparency concerns. Furthermore, economic fluctuations can threaten job creation requirements, while evolving program rules might modify program expectations and eligibility. Consider these obstacles to safeguard your EB-5 investment and immigration success.

The Vital Importance of Legal Guidance for EB-5 Projects

Professional legal counsel shapes your EB-5 journey at every stage, preventing serious errors that may result in major holdups or application refusals. Legal professionals offer invaluable support throughout the visa process, from clarifying investment requirements and workforce development obligations to maintaining adherence to USCIS regulations.

Your legal counsel will guide you through due diligence when reviewing potential investment projects, whether direct or through Regional Centers. They'll help you navigate the challenges of visa adjudication and handle any legal matters that come up in your application.

Although not mandatory, legal representation is crucial for a successful outcome. A skilled immigration lawyer collaborates with government officials, project developers, and regional centers to establish a comprehensive legal strategy. With substantial financial and personal stakes at stake, proper guidance from qualified legal counsel improves your likelihood of securing permanent residency.

Popular Questions

Are Family Members Allowed to Process Visa Applications in Various Countries

Family members can schedule their visa interviews at different locations if they reside in different countries. Each applicant usually conducts their interview at the nearest U.S. Embassy or Consulate to their residence. Contact the U.S. Embassy or Consulate directly to coordinate interviews in different locations. This option makes the immigrant visa process easier for families located in multiple countries.

Do Investors Need Business Experience or English Language Skills?

Concerned about if you must have business expertise or English fluency for an EB-5 copyright? You'll be glad to know there aren't any requirements for business background, education, or language ability when applying for an EB-5 investor visa. Your application processing won't be delayed because of absence of business experience. You only need to satisfy the investment requirements and demonstrate you'll take part in managing the business.

Do I Need to Live Where My EB-5 Project Is Located?

There is no requirement to live where your EB-5 project is located. The EB-5 program has no residency requirements connecting you to your project location. Once your I-526E petition is approved and you receive your conditional copyright, you can settle anywhere in the United States. Your investment must remain eb5 green card at risk for at least 24 months, but your physical residence is not limited to the project's location.

What Protections Exist for Your Investment Funds While in Escrow?

Your investment funds placed in escrow receive multiple safeguards. Escrow accounts serve as a crucial financial safeguard, particularly for significant EB-5 investments. You'll benefit from FDIC insurance through Insured Cash Sweep (ICS), which thoroughly secures your $800,000 investment as opposed to just $250,000 without ICS. The escrow agreement ensures your funds will be released when your I-526 petition is accepted or refunded if denied, offering investment security through this binding contract with a third-party escrow agent.

Can I Travel Outside the U.S. After Getting My copyright?

Upon obtaining your copyright, you're free to travel internationally. As a copyright, you are permitted to leave the United States, but your stays abroad should not be permanent. For absences under one year, you don't need additional documentation. However, if you expect to stay abroad beyond one year, apply for a reentry permit (Form I-131) before your trip. Stays abroad exceeding 180 days might impact your immigration standing.

Conclusion

Maneuvering through the EB-5 process is more than just figures—it's a journey where each element is crucial. You'll need to meet specific investment requirements, prove lawful funding, and secure job creation, all while moving through a complex application process. Think of an experienced EB-5 attorney as your navigator: they don't just guide, they work to prevent challenges, translating detailed requirements into achievable steps on your road to permanent residency. Your copyright goal requires precision; partner with an expert.

Report this page